Special Tax Regularization Program bill sent to the House of Representatives

The reopening of the Special Tax Regularization Program was approved by the Senate last week

Subjects

On August 5, 2021, the Brazilian Senate passed Bill No. 4,728/2020 regulating the registration deadline for the now-reopened Special Tax Regularization Program (PERT). Instituted by a 2017 law, the bill introduces new conditions related to the economic effects of the pandemic. Taxpayers can join the program until September 30, 2021.

Decrease in tax debts

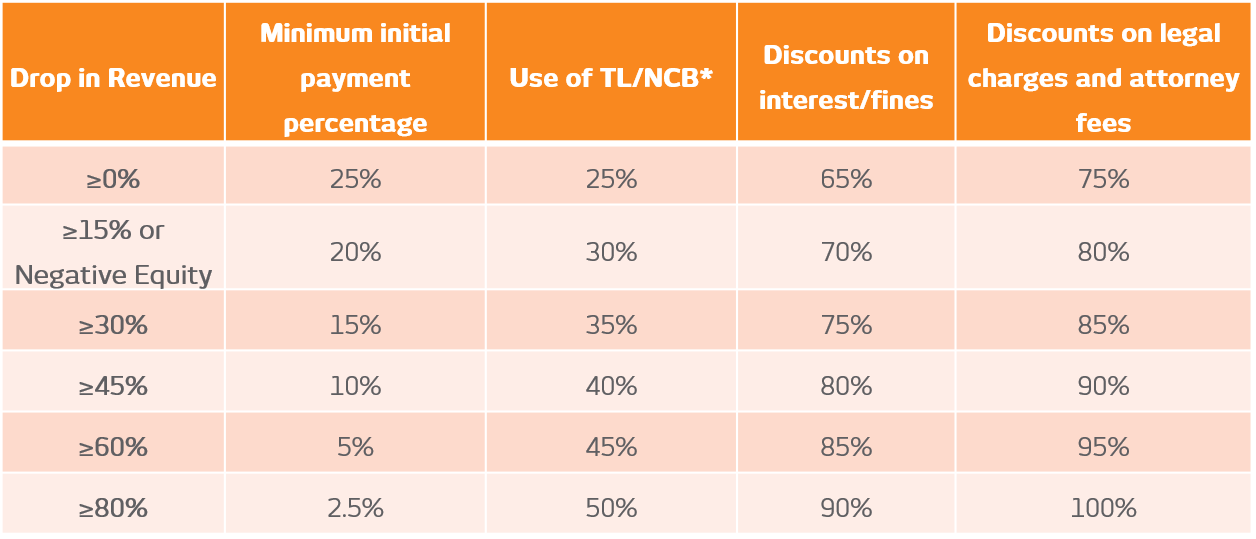

The proposal allows overdue tax debts to be included in the program until the final day of the month in which the resulting law takes effect. The bill grants benefits to reduce tax debts proportionally to the taxpayer’s losses during the Covid-19 pandemic (from March to December 2020) in comparison with their results in the same period of 2019.

Among possible forms of payment, the bill establishes that taxpayers can make initial payments in cash in up to five installments, with no reduction to the consolidated debt. It is also possible to settle part of the debt with a tax loss and a negative CSLL (Social Contribution on Net Income) calculation basis. For the remaining debt, discounts are granted on interest, fines, and related legal charges.

The program’s general rules and categories

PERT’s general rules are described below:

- Companies that did not experience a decline in revenue are allowed to register;

- The use of rights that the taxpayer holds in relation to public entities and federal public foundations is authorized to offset debts registered as an overdue federal tax liability;

- Taxpayers who were initially excluded from PERT due to the non-payment of installments for debts due after April 30, 2017, or for the obligations with the Guarantee Fund for Time of Service (FGTS) compliance are allowed to register;

- There is a 60-month limit for paying installments on social security contributions;

- Including debts in a new installment method is prohibited for 149 months from the first month the PERT is reopened; and

- The initial payment can be made in five installments until January 2022.

Categories based on reductions in company revenue (as per Bill No. 4,728/2020)

March-December 2020, compared to March-December

2019

* Tax loss and negative CSLL calculation basis.

PS:The remaining balance can be paid in up to 144 installments.

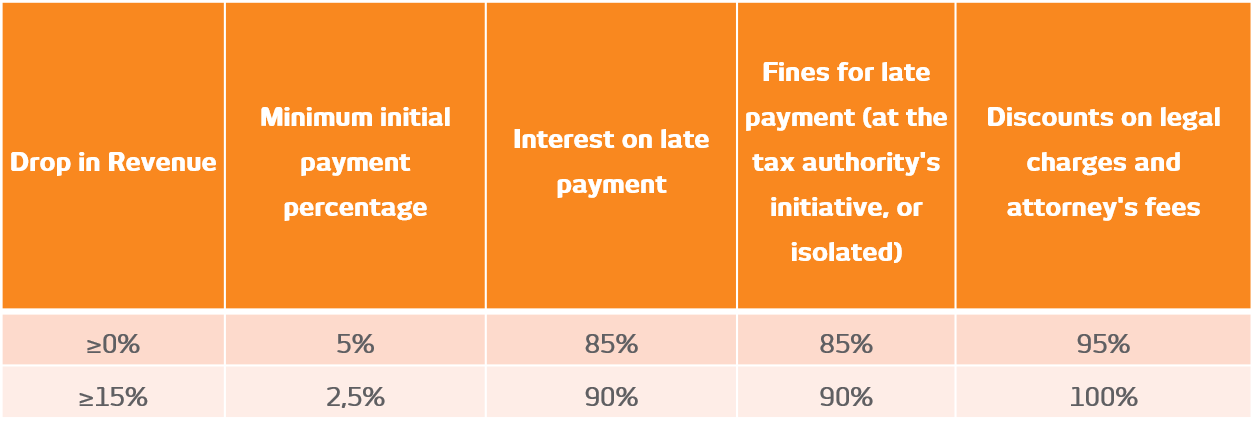

Renegotiation conditions are more favorable for individuals, with a lower initial payment percentage and higher discounts, as shown in the table below:

Categories based on the reduced sum computed in the Annual Adjustment Statement calculation basis (as per Bill No. 4,728/2020)

2021 fiscal year (2020 calendar year),

compared to the 2020 fiscal year (2019 calendar year)

Extending the possibility of “negotiating” tax debts

Finally, the bill also proposes improvements to laws concerning the Register of Unpaid Credits from Federal Agencies and Entities and tax transactions. We have highlighted some aspects below:

The Attorney-General’s Office of the Brazilian Treasury (PGFN) is authorized to stop the continuation of procedural acts, including the withdrawal of appeals already filed;

Lawsuits that are awaiting judgment can be settled if they meet rationality, economic, and efficiency criteria;

- The PGFN and the Brazilian Federal Revenue are authorized to negotiate debts directly with taxpayers;

- Non-tax credits managed by federal agencies and public foundations can be added to transactions, except for those managed by the Brazilian Central Bank (Bacen);

- The PGFN is authorized to use the tax credits and negative CSLL calculation basis of the taxpayer, (or a company within the same economic group) to settle up to 70% of the remaining balance after the discounts — except for social security contributions, in which the use of these credits may pay off the entire debt;

- Authorization to use either the taxpayer’s (or a third party’s) federal court-issued warrants or the taxpayer’s liquidated credits (whose value has been expressly recognized by a final and unappealable decision) or credit rights recognized by the Federal Government, for the purpose of repaying or settling the debt;

- An increase in the maximum installment transaction period from 84 to 120 months, as well as the maximum discount that can be granted to the debtor for a reduction of up to 70% of the total debt amount, both in relation to the general rule of transaction of credits registered as overdue tax liability, and in the transaction carried out due to relevant and widespread legal controversy;

As noted, the program aims to expand the possibility of negotiating tax and non-tax debts under the responsibility of the federal tax administration. The proposal is an important step to mitigate the fiscal impact upon the State and provides a good opportunity for taxpayers to regularize their tax debts.

The bill was sent to the House of Representatives for further analysis, where it may still be altered. If no amendments are made, the period for analyzing debts, financial planning and applying for the program is expected to be short, considering the September 30 deadline.

For more information about the Special Tax Regularization Program, please contact Mattos Filho’s Tax practice area.