Tax settlement: a possibility

Mattos Filho outlines conditions for the different forms of settlement now viable in Brazil

Subjects

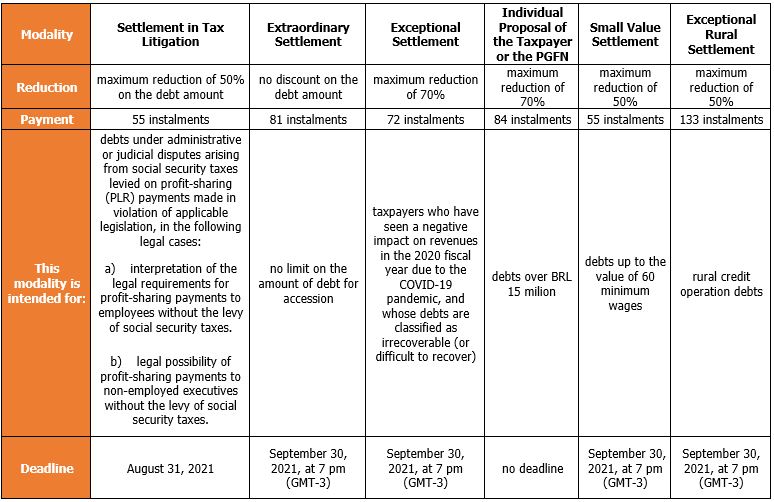

Among measures for regulating settlements of tax cases, Law No. 13,988/2020 took effect in 2020, providing for federal tax debt liquidation with the Brazilian Revenue Service (RFB) and/or the Office of the General Counsel for the National Treasury (PGFN), as summarized below:

Although Brazil has only allowed settlements under very specific conditions – valid for specific base periods – we can see a new scenario emerging in terms of alternative methods for dispute resolution regarding federal, state and municipal taxes.

For further information about the procedures, obligations, and requirements for the tax settlement modalities, please contact Mattos Filho’s Tax practice area.