Merger Control: a 2023 retrospective and the outlook for 2024

An overview of the Brazilian antitrust authority's enforcement of merger control and trends on the horizon for 2024

In 2023, the Brazilian Antitrust Authority (CADE) analyzed 611 merger transactions. 92% of these (559) were subject to the authority’s fast-track review, and 8% (52) were subject to the regular review proceeding, with eleven of these cases eventually examined by CADE’s Tribunal. The total value of the merger transactions reported in 2023 amounted to BRL 905 billion (approximately USD 182 billion considering the exchange rate in early March 2024). Reviews of transactions filed via the regular proceeding were completed in an average of 116.7 days (down from 125.6 days in 2022), while those filed via the fast-track proceeding took an average of 12.6 days (down from 21.4 days in 2022), suggesting the authority has been able to increase its efficiency in reviewing merger cases.

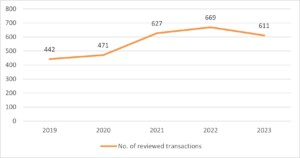

The numbers also indicate a slight decrease in the number of transactions reviewed compared to 2022, likely due to the global political and macroeconomic scenario. Despite this drop, there has been a significant overall increase in the number of reviewed transactions in the last five years (41% more in 2023 than in 2019).

Transactions reviewed by CADE between 2019 and 2023

2023 was marked by a record number of gun-jumping investigations, with CADE concluding 54 in total. Of these, 31 were concluded after the parties involved provided information, while 23 were converted into administrative proceedings (APACs) for further investigation. These figures underscore how important it is for companies to carefully assess whether their corporate transactions (such as mergers, acquisitions, or even partnerships) would be subject to mandatory filing and clearance in Brazil.

CADE has the power to request a transaction be submitted for review even if revenue thresholds are not met, provided the request is made within one year of the date of closing. In a 2023 highlight, CADE requested a transaction between MaxMilhas and 123 Milhas be submitted due to concerns about potential negative market effects on travel agencies operating in the online air ticket market, indicating the authority remains focused on new developments in market consolidation.

Key developments and trends for 2024

CADE reviewed a number of important transactions throughout 2023, issuing a number of landmark decisions that are expected to shape Brazil’s antitrust policy in 2024.

One key point concerns CADE’s growing concern with long-term partnerships (such as joint ventures and collaboration agreements), especially among competitors with a significant presence in their respective sectors. For example, when CADE approved a consortium among Ultragaz, Bahiana Distribuidora, Supergasbras, and Minasgás (Merger Case No. 08700.004940/2022-14), the extension of a joint venture between SBT, Record, and RedeTV (Merger Case No. 08700.009574/2022-81), and a joint venture BusCo between Viação Águia Branca and JCA (Merger Case No. 08700.002488/2022-48), the approval was conditioned upon certain restrictions. In the first two cases, the restrictions focused on limiting the duration of the partnerships (which would require further review if the duration were extended) and on ensuring that smaller players requiring access to infrastructure or services offered by the partnership could enter or remain in the market. In the third case, the restrictions sought to ensure the joint venture’s operational independence, to prevent sensitive information from being exchanged among shareholders, and to make sure these companies would continue to compete in markets vertically related to the joint venture.

In a similar vein, CADE continued to voice concerns over vertical mergers in 2023, particularly in markets where antitrust investigations are ongoing or have taken place. These concerns were evident in a transaction where the oil and gas group Grepar acquired the Mucuripe Refinery (Merger Case No. 08700.004304/2022-84), which was cleared with commitments aimed at preventing potential discrimination against asphalt companies that were not affiliated with Grepar.

2023 also saw CADE scrutinize a cooperation agreement between two companies in the same sector for the first time. The agreement regarded the development and operation of a platform to standardize sustainability measurements in food and agricultural supply chains. The case concerned a joint venture between SustainIt, Cargill, Louis Dreyfus, and ADM (Merger Case No. 08700.009905/2022-83 – mentioned in one of our previous bulletins) and prompted statements from CADE’s commissioners about the relationship between competition and sustainability goals. It served as a basis for objective parameters on the type of safeguards such undertakings should apply, provided via an antitrust protocol robust enough to address potential competition concerns focused on risks derived from exchanging competitively sensitive information and establishing equal and non-discriminatory standards.

New developments in 2024

CADE launched the e-Notifica system late in 2023, creating an online process for filing transactions with the enforcer (also discussed in one of our previous newsletters). Integrated with the Brazilian government’s database, the system promises to streamline how companies can gather information and allows for payment of the filing fee via the PIX instant payment method or credit card. Currently, using the system is optional and available only for transactions submitted for the fast-track review proceeding. In the future, it is expected that CADE will be able to automate the drafting of clearance decisions – particularly for simpler transactions – thereby expediting review timeframes.

One final important development for 2024 concerns the expected release of CADE’s Non-Horizontal Merger Analysis Guidelines (V+ Guidelines), with the draft version having already been put to public consultation in 2023. The V+ Guidelines aim to systematize CADE’s decision-making process in non-horizontal mergers – an initiative of paramount importance and one that should provide greater transparency around the authority’s criteria for reviewing this type of transaction.

For further information on competition law matters in Brazil, please contact Mattos Filho’s Antitrust practice area.