Brazilian Securities and Exchange Commission publishes guidance on cryptoassets and the securities market

The document seeks to consolidate the CVM's view on the regulatory environment applicable to crytpoassets, ensuring safety and transparency

Published on October 11, 2022, CVM Guidance Opinion No. 40 consolidates the instructions for classifying cryptoassets as securities. It also defines the limits of the Brazilian Securities and Exchange Commission’s (CVM) scope of regulation and how it may standardize and supervise the activities of capital market players.

The guidance defines cryptoassets as digitally represented assets protected by encryption that can be used in transactions and registered via Distributed Ledger Technologies (DLTs). Cryptoassets are usually represented by tokens – which are intangible digital titles.

In the guidance opinion, the CVM reiterates that it is open to new technologies that may positively support the development of the securities market. The CVM believes that new technologies can potentially expand — and not limit — the rights that may apply in this area.

Accordingly, the CMV informs that it will continue to analyze all new technologies and how they may apply to the capital markets, potentially regulating this new market if necessary and as appropriate – especially considering the experience with the Regulatory Sandbox.

How the CVM will treat cryptoassets

The CVM has adopted a receptive and favorable approach towards the development of cryptoassets environment, as they contribute to the advancement of the securities market.

The CVM also clarified no prior approval or registration would be required for tokens. However, the issuance and public offering of such tokens should be subject to applicable regulation, as well as the organized market entities where such tokens may be exchanged and bookkeeping, services of custody, centralized deposit, registration, clearing and settlement service providers.

Guidance Opinion No. 40 consolidates the understanding of the standards applicable to such assets, aiming to protect investors, prevent tax evasion and money laundering, and combat terrorism financing and corruption.

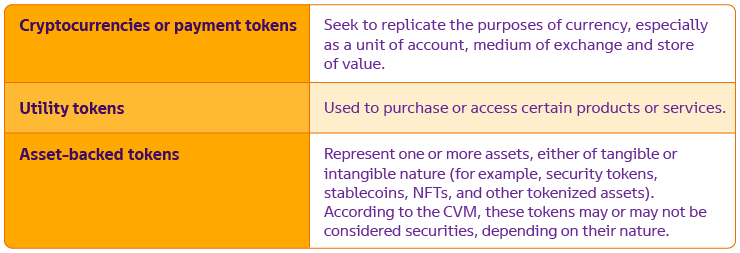

Token’s taxonomy

CVM adopts the following taxonomy framework with the purpose of providing the appropriate legal treatment for cryptoassets:

Classification as security

The CVM’s guidance indicates that cryptoassets can be considered securities when they digitally represent securities provisioned in items I to VIII, article 2, of Law No. 6,385 and/or Law No. 14,430 (i.e., certificates of receivables in general), or when they fall into the concept of collective investment contracts (CIC), observing the following requirements:

- Investment: payment made either in cash or using assets susceptible to economic evaluation;

- Formalization: formalization of a title or contract as a result of the relationship between investors and offerors;

- Collective nature of the investment: funds raised by investors for a common interest;

- Expected economic benefit: the right to some form of interest, partnership, or remuneration arising from the enterprise’s success. For instance, the interest on earnings arising from an investment — provided that these earnings result from the efforts of the entrepreneurs or third parties, and not from external factors beyond the entrepreneurs’ control. Accordingly, cryptoassets that entitle their holders to any portion of the earnings from investments — including via capital redemption, remuneration agreements, and dividend income — in principle, meet this requirement.

- Entrepreneurs’ or third parties’ efforts: economic benefit resulting from the nature and extent of the efforts exerted by entrepreneurs or third parties other than investors. This requirement is met, for instance, under circumstances where the creation, development, operation, or promotion of the investment depends on the efforts exerted by the investors or third parties; and

- Public offering: efforts to raise funds from the public. As for checking whether the public offering requirements were met, the CVM determines that Guidance Opinions No. 32/05 and No. 33/05 must be observed for the distribution of tokens – especially via the internet, with no geographic restriction. The CVM will analyze specific cases concerning the implementation of effective measures to prevent broad access by the general public to the offer page and the use of communication intended to reach the general public residing in Brazil. Securities issued abroad and offered in Brazil may not be in compliance if they are not registered with the CVM.

The CVM also highlights that it follows the US Supreme Court’s interpretation of the Howey Test for the classification of CICs. However, Brazilian authorities may have a different interpretation, depending on the case.

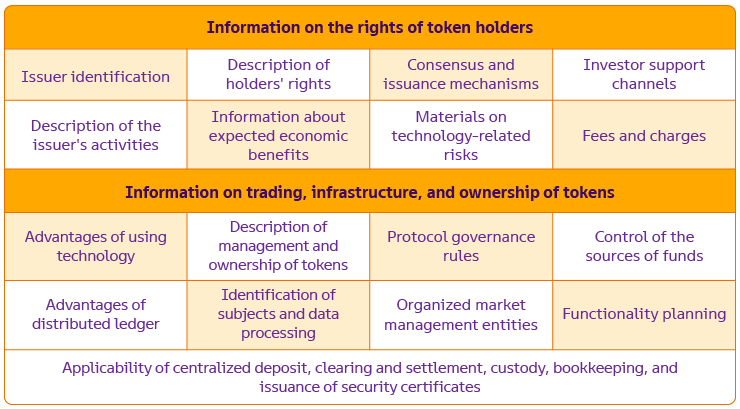

Informational regime and role of intermediaries

In line with the principle of full and fair disclosure, CVM Guidance Opinion No. 40 sets forth minimum information that should be provided in plain language to the public and the market in general, summarized below:

Intermediaries offering cryptoassets must comply with CVM regulations and ensure adequate transparency and information, especially when digital assets are offered directly and not through regulated products.

Investment funds

CVM Guidance Opinion No. 40 ratifies CVM’s understanding of the possibility and terms for direct and indirect investments in cryptoassets via investment funds set up in Brazil.

In this regard, CVM Circular Letter No. 1/2018 (January 12, 2018), which refers to investments in cryptocurrencies by funds regulated under CVM Instruction No. 555/14, does not classify these tokens as financial assets for the purposes of article 2, item V, which would limit their acquisition by regulated investment funds.

Also, CVM Circular Letter No. 11/2018 (September 19, 2018) provides that CVM Instruction No. 555/14, articles 98 et al., referring to investments abroad, authorizes investments in cryptoassets and derivatives traded in exchanges or foreign market entities, as long as they are regulated and supervised by a regulator in that jurisdiction.

Whatever the case, CVM reiterates that it is up to the administrator and fund manager, in compliance with the duties imposed by the regulations and especially concerning these assets based on innovative technologies, to assess the appropriate level of disclosure of potential risks (for example, in the fund’s mandatory disclosure materials) and to observe criteria and steps aimed at greater levels of transparency.

Final considerations

The CVM is attentive to the marginal market of cryptoassets which may be classified as securities. It will continue adopting all applicable legal measures to prevent and punish any violation of the Brazilian securities market’s regulation.

The CVM recognizes that, in the current global scenario, there is a lot to discuss on how to regulate these assets. Therefore, the guidelines provided in CVM Guidance Opinion No. 40 do not exhaust the discussions on this matter, which is undergoing constant innovation.

For further information on cryptoassets, please contact Mattos Filho’s Cryptoassets practice area.