Presidential decree amends the regulation of the Brazilian Anti-Corruption Law

The decree introduces changes and incorporates guidelines previously adopted by the CGU to standardize and define concepts and procedures

Subjects

Decree No. 11,129/2022 was enacted on July 12, 2022, revoking Decree No. 8,420/2015 and establishing new regulations in connection with Brazil’s Anti-Corruption Law (Law No. 12,846/2013).

Effective from July 18, 2022, the decree applies to ongoing administrative enforcement proceedings and leniency agreement negotiations, excluding acts before this date.

A redline version comparing the changes between Decree No. 11,129/2022 and Decree No. 8,420/2015 is available here (in Portuguese).

Preliminary investigations

The new decree contains guidelines for opening preliminary investigations prior to the start of administrative enforcement proceedings, which the Federal Comptroller General’s Office (CGU) had previously adopted via CGU Instruction No. 13/2019. The guidelines authorize the CGU to conduct certain investigations – although some of these are subject to court authorization, including requests for sharing tax information and search and seizure warrants.

Preliminary investigations must be completed within 180 days, though this timeframe may be extended with the authorization of the internal affairs department of the government entity with legal jurisdiction to conduct the investigation.

Changes to administrative enforcement proceedings

Decree No. 11,129/2022 also contains more elaborate provisions for administrative enforcement proceedings while both including and improving previously established procedures from CGU Instruction No. 13/2019. Among the new procedures, Decree No. 11,129/2022 sets forth that the administrative enforcement commission must prepare administrative charges containing:

- A clear and objective description of the harmful acts the legal entity is alleged to have committed and the relevant circumstances;

- Adequate evidence to support the indictment; and

- The specific legal grounds for the charges.

The decree also introduces the possibility of using the same enforcement proceedings to investigate alleged violations of the Anti-Corruption Law and administrative infractions under the New Public Procurement Law (Law No. 14,133/2021).

However, in contrast to the previous regulations, the decree was enacted without specific wording regarding the need for proceedings to remain confidential in order to preserve the images of those involved. Therefore, additional efforts may now be required to secure the confidentiality of investigations and whistleblowers.

Decree No. 11,129/2022 also provides for the possibility of suspending administrative enforcement proceedings by initiating leniency negotiations. The suspension of the proceedings may now occur at the CGU’s discretion, without prejudice to the continuation of the investigative measures necessary to clarify the facts or the adoption of precautionary and protective procedural measures to avoid the loss of rights or ensure the evidence production stage is carried out.

Changes to calculating undue advantage

The decree defines improper advantage as gains or benefits the legal entity obtains (or intends to obtain) that result directly or indirectly from harmful acts.

There are three different methods for calculating undue advantage:

- Identifying the total amount of revenue earned in an administrative contract (and its amendments) and deducting the legitimate costs the legal entity can prove are attributable to the contract;

- Identifying the total amount of expenses or costs avoided, including tax or regulatory costs;

- Estimating the additional profit earned from an action or omission by the government, which would not have occurred had the legal entity not committed any misconduct.

The regulation emphasizes that financial sums paid as bribes to public authorities or related third parties must not be treated as deductible expenses when calculating the amount of profit.

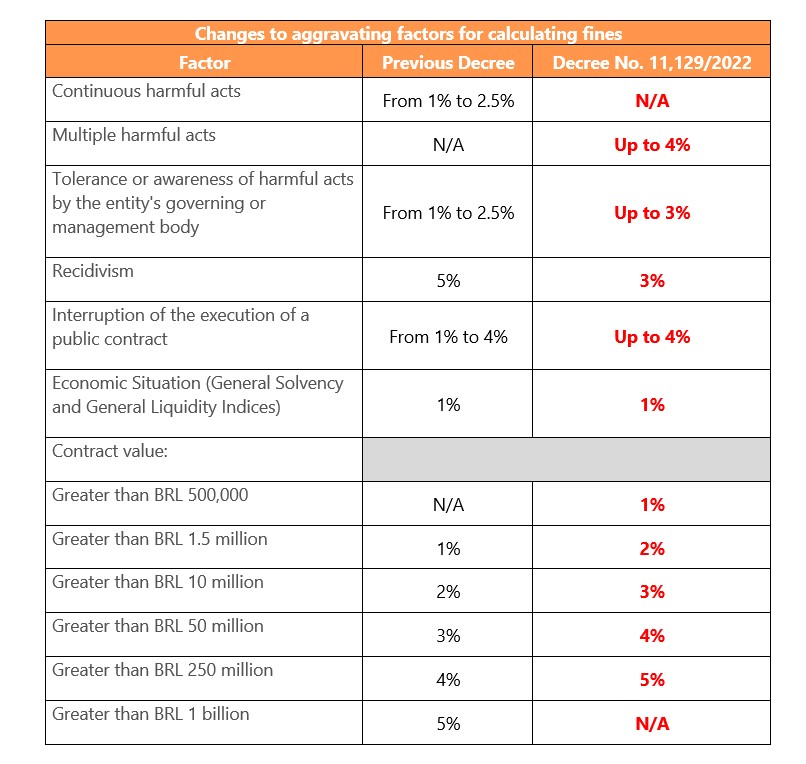

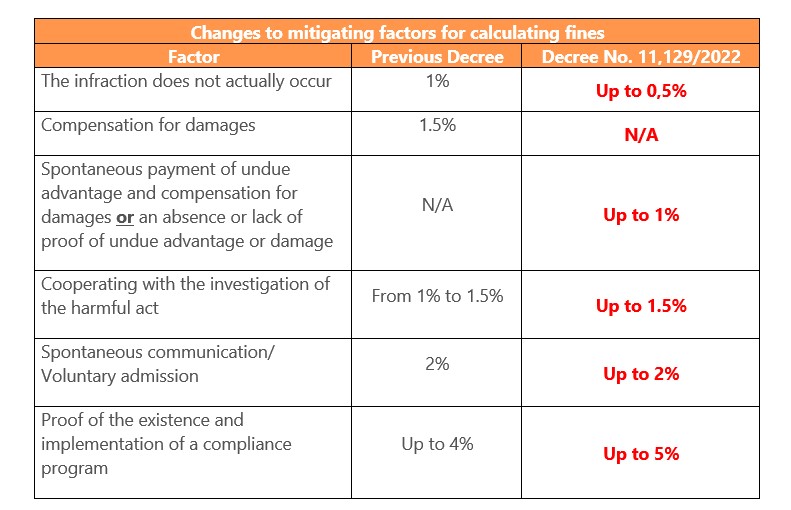

Changes to aggravating and mitigating factors

Decree No. 11,129/2022 introduces important changes to how penalties provided for in the Anti-Corruption Law are calculated, significantly changing the percentages used to calculate fines. The tables below outline the changes to the aggravating and mitigating factors used in the calculations:

Aggravating factors

Mitigating factors

Leniency agreements

Decree No. 11,129/2022 establishes that the CGU can now negotiate, execute and monitor leniency agreements for harmful acts against other government branches, such as state and municipal authorities.

Moreover, financial sums paid to cover damages can be used as a credit against other penalties imposed by other authorities when these penalties are related to the same facts covered by the scope of the leniency agreement.

The decree enables the renegotiation of leniency agreements provided certain requirements are met. These include maintaining the results and original requirements the leniency agreement was based on, greater advantages for the public administration, and the cooperating legal entity’s good faith in committing to fulfilling an obligation before its deadline.

The decree also sets rules for cooperation between the CGU and the Office of the General Counsel of the Federal Government (AGU), and provides that the AGU’s participation may lead to a joint resolution of the civil penalties established in the Anti-Corruption Law. Furthermore, negotiations for executing leniency agreements and monitoring their performance will be regulated further by a joint act issued by the CGU’s Minister of State and the AGU.

Corporate integrity programs

With regard to corporate integrity programs, Decree No. 11,129/2022 emphasizes the need for legal entities to implement robust and efficient corporate governance, and encourages them to uphold a culture of integrity.

The decree has updated the wording of previously established factors used to determine the effectiveness of corporate integrity programs. It has also reemphasized the need for legal entities to adopt effective risk management and adequate due diligence procedures, especially when hiring third parties, Politically Exposed Persons (PEPs), and providing and supervising sponsorships and donations.

Moreover, the decree explains that the CGU’s process for evaluating corporate integrity programs will consider the legal entity’s revenue and corporate governance structure, in addition to the aspects already described above.

For further information, please contact Mattos Filho’s Compliance & Corporate Ethics practice.