New tax rules in Brazil for offshore assets

Provisional Measure No. 1,171/2023 modifies the taxation regime for offshore assets held by individuals residing in Brazil

Subjects

On April 20, 2023, the Brazilian Federal Government published Provisional Measure (MP) No. 1,171, substantially altering the tax rules applicable to offshore investments made by Brazilian individuals.

The MP came into effect on May 1, 2023, but it will need to be reviewed by the Brazilian Congress to be effectively converted into law. Congress has up to 120 days to evaluate, propose changes, or approve the MP – otherwise, it will automatically be revoked.

Financial investments abroad

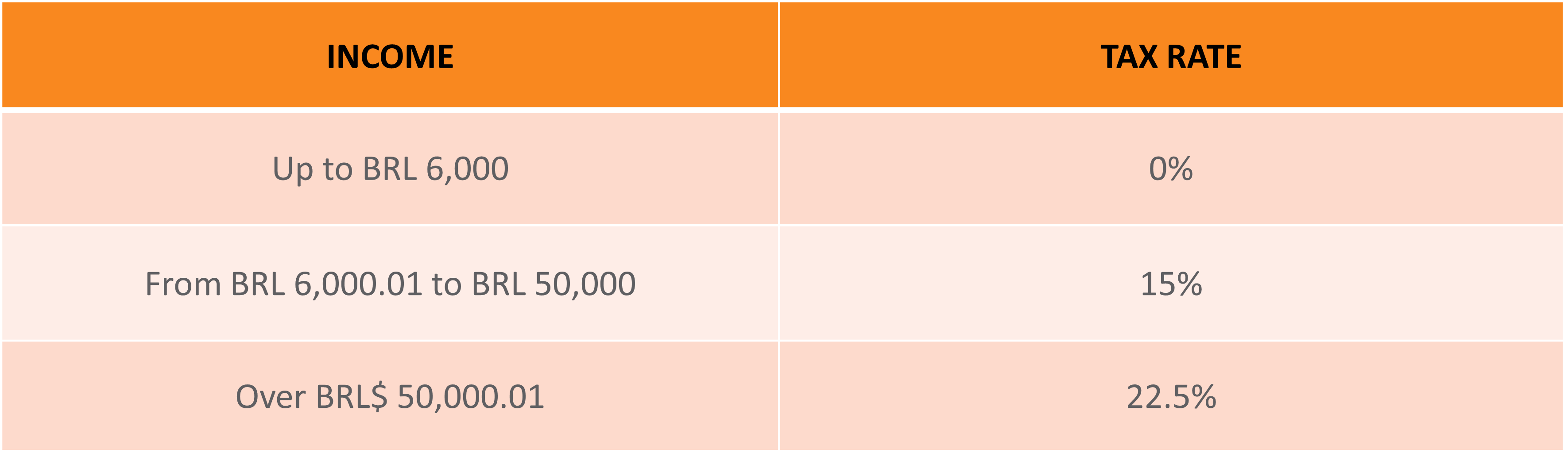

Direct financial investments made abroad by individuals residing in Brazil will only be taxed upon any redemption, disposal or maturity date of interest/income. These investments are subject to income tax in Brazil based on the progressive rates below:

It is worth noting that MP No. 1,171/2023 adopts a broad concept of ‘income’, including gains stemming from exchange rate variations and sales of shares in uncontrolled entities on foreign stock exchanges.

Offshore entities

One of the most important changes that MP No. 1,171/2023 introduces concerns the taxation of offshore entities controlled by individuals residing in Brazil.

What types of offshore entities does MP No. 1,171/2023 affect? Companies and other entities (even those with no legal personality), such as investment funds and foundations controlled by Brazilian individuals, fall within the scope of MP No. 1,171/2023 if:

- The entity is located in Favorable Tax Jurisdictions (FTJ) or subject to Privileged Tax Regimes (PTR) as defined by applicable Brazilian regulations; or

- The entity’s active income is less than 80% of its total income (active income does not include royalties, interest, dividends, equity interest, property leases, capital gains arising from assets held for less than two years, and financial investments).

What does MP No. 1,171/2023 define as a ‘controlled entity’? Entities controlled by individuals who, either individually or jointly with related parties:

- Hold majority power in regard to corporate decisions or have the power to appoint or remove most administrators; or

- Hold more than 50% of the entity’s capital, rights to receive profits, or assets in the event the entity is liquidated.

What new taxation rules exist for controlled entities? According to the new rules, the profits of controlled offshore entities within the scope of MP No. 1,171/2023 that are generated as of January 2024 will be subject to income tax based on the progressive rates mentioned in the table above. This tax will be charged on December 31 of each year, regardless of any distribution of profits or redemption of shares/quotas. Taxed profits will be added to the acquisition costs of individuals residing in Brazil, with no additional taxation when the taxed profits are made available (individuals just need to deduct the cost of the asset when filing their Brazilian tax returns).

What happens to profits generated prior to January 2024? Profits gained before January 2024 will only be subject to taxation in Brazil when individuals gain access to them, as per the current rules.

Trusts

MP No. 1,171/23 sets forth the rules applicable to trust arrangements structured outside of Brazil. In general, trusts are considered look-through structures for tax purposes, particularly in regard to asset recognition, declaration criteria for the settlor and beneficiaries, and applicable taxation. MP No. 1,171/23 does not distinguish between categories of trusts (including revocable or irrevocable trusts), meaning that the rules apply indiscriminately.

How must trusts be declared? The settlor is considered the direct holder of any assets held in a trust during their lifetime, or before they are distributed to beneficiaries. Such assets are subject to the rules established in MP No. 1,171/2023 depending on the type of asset (financial investment, controlled entity, real estate, among others).

How are distributions taxed? Any distributions carried out during the settlor’s lifetime are considered gifts to the beneficiary, while distributions made due to the settlor’s death are considered inheritance.

Updating the value of offshore assets

MP No. 1,171/2023 allows individuals to update the value of their offshore assets (including financial investments, real estate, vehicles, aircraft, and shares in controlled entities) according to their market value on December 31, 2022. The difference between the current acquisition cost and the market value will be subject to income tax at a fixed rate of 10%, which must be paid by November 30, 2023.

Updates to the value of controlled entities can also be made based on the market value on December 31, 2023 (provided that the update was made on December 31, 2022), and the additional income tax (also 10%) must be paid by May 30, 2024.

This prerogative also applies to assets held via trusts. However, it does not apply to assets that were not included in the tax return for the 2022 fiscal year, among other specific situations.

Final considerations

The MP effectively revokes certain important provisions that applied to individuals residing in Brazil, such as income tax exemptions on the sale of offshore assets previously acquired when the individual had non-resident status, and exemptions on the foreign exchange variation assessed in the disposition of offshore assets that were originally acquired in foreign currency.

For further information, please contact Mattos Filho’s Private Client practice area.