Brazil’s Congress overrules nine vetoes regarding BR do Mar program

Reporto tax regime to continue until 2023; AFRMM tax rate reduction set to go ahead

Subjects

On March 17, 2022, the Brazilian Congress concluded its analysis of the partially vetoed Law No. 14,301/2022, which recently created the Program to Stimulate Transportation by Cabotage (BR do Mar, in Portuguese).

Congress overruled items 5 to 13 of the presidential veto, with the following changes standing out:

Reporto tax regime

One of the overridden vetoes would have prevented the return of the Tax Regime for Modernization and Expansion Incentives of Port Structures (Reporto), a tax benefit for the port sector that came to an end in December 2020.

Consequently, Reporto will remain valid until December 2023, with the benefit also being expanded to dredging companies, bonded warehouses in secondary zones, as well as professional training and multifunctional training centers for port workers.

AFRMM Tax

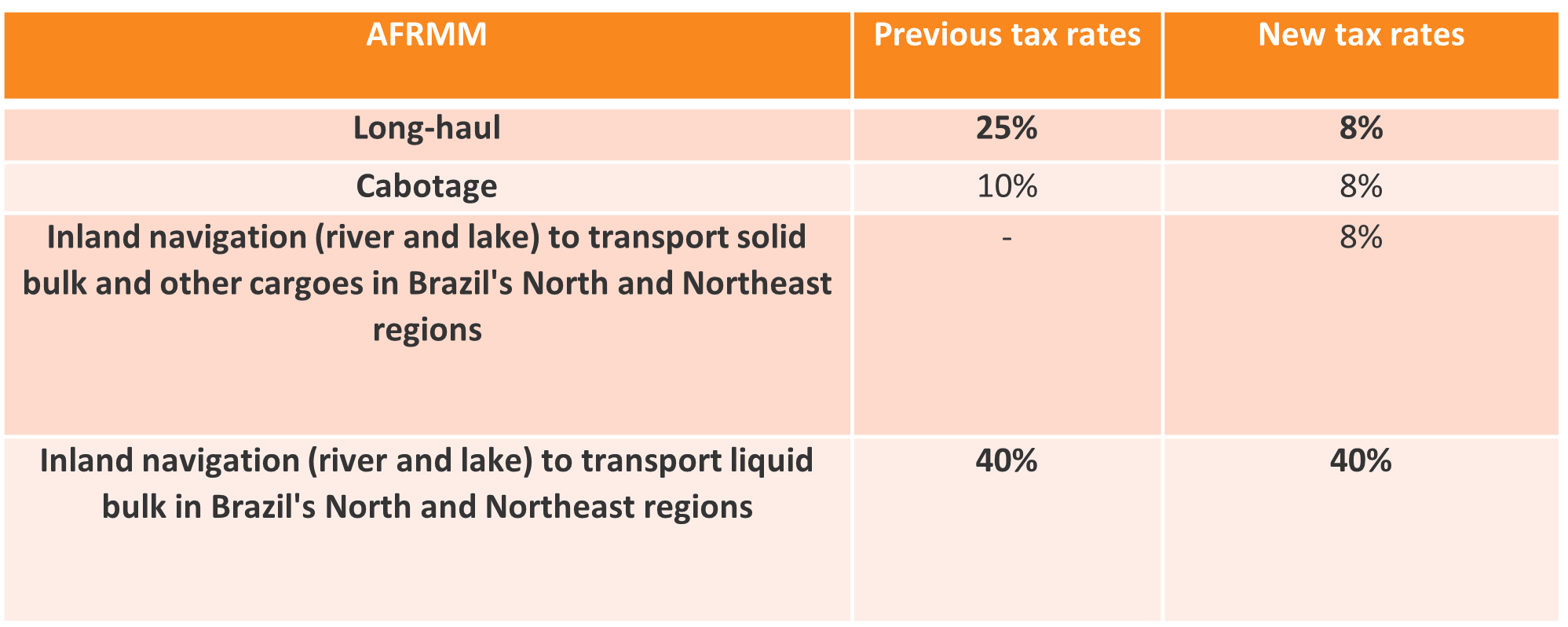

Congress also rejected a veto preventing the reduction of Tax on Freight for Maintaining the Merchant Navy (AFRMM), levied on the freight charges of shipping companies operating in Brazilian ports.

In light of the rejected veto, the AFRMM tax rates will be levied as follows:

Crew onboard foreign ships

Previously, Congress approved a version of the BR do Mar Law that established that two-thirds of crew members on board foreign vessels chartered under the BR do Mar program must be Brazilian nationals. This provision was also vetoed.

However, Congress decided to uphold the presidential veto in this instance. Therefore, for foreign vessels chartered under the BR do Mar Program:

- Only the captain, cabotage master, chief engineer and fitter must be Brazilians, and

- A general rule on crew proportionality for cabotage vessels provided for in Normative Resolution CNIG No. 6/2017 will continue to apply. Thus, one-fifth of the crew must be Brazilian after 90 days, rising to one-third after 180 days.

For further information on this topic, please contact Mattos Filho’s Infrastructure & Energy practice area.